On 7 August 2025, the Bank of England (BoE) lowered its key interest rate from 4.25% to 4%, marking the fifth cut since August 2024 and returning borrowing costs to levels not seen since March 2023. This closely fought decision was settled only after a rare two‑round vote — a 5‑4 split that underscores deep uncertainty over inflation and growth.

Table of Contents

What’s Behind the Decision?

– Inflation worries persist: With headline inflation already at 3.6% in June and projected to peak at 4% in September, the BoE remains cautious despite the rate cut.

– Fragile growth & rising unemployment: GDP growth slowed to just 0.1% in Q2 2025, while unemployment edged up to 4.7%, the highest in four years.

– Unprecedented internal deadlock: The need for a second vote reflects growing division within the Monetary Policy Committee about the optimal policy path.

Why Has the BoE Cut Rates?

The BoE has two key goals:

1. Keep inflation close to the 2% target

2. Support economic growth and employment

Currently, inflation sits at 3.6% and is expected to rise to around 4% in September due to higher food and energy prices. Meanwhile, economic growth has slowed to 0.1% in Q2 2025, and unemployment has risen to 4.7% — the highest in four years. The BoE believes a small rate cut can ease financial pressure without reigniting excessive borrowing.

How This Affects You

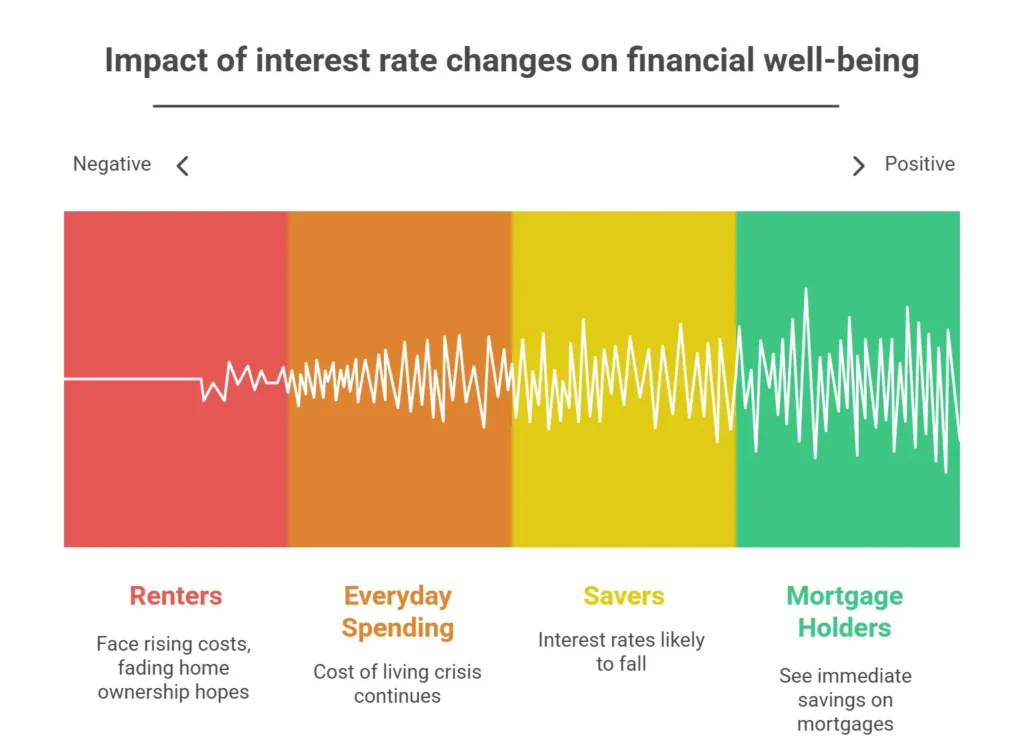

1. Mortgage Holders

– Tracker and variable‑rate borrowers benefit immediately: Over 1.1 million UK homeowners on tracker or SVR mortgages are set to see their mortgage rates fall by around 0.25 percentage points. Banks like Barclays, HSBC, Nationwide, Lloyds, Halifax, and Metro Bank have confirmed cuts, although timing varies by lender.

– Monthly savings expected: Borrowers on trackers may save around £350 annually, while those on SVRs could see ~£166 savings per year.

– Fixed‑rate borrowers unaffected for now: Roughly 85% of mortgage holders on fixed‑rate deals won’t benefit until their terms expire.

– New fixed deals becoming more competitive: Average two‑ and five‑year fixed rates have dipped below 5%, with some lenders offering sub‑3.8% deals to well‑qualified buyers.

2. Savers and Those Saving

– Interest on savings expected to fall: Easy‑access and cash ISA rates are likely to be trimmed following the base rate cut, though fixed‑rate bonds still yield between 4.44% and 4.47%.

– Savers should consider fixed‑term options or shop around for top rates to protect their returns.

3. Renters and Housing Market

– Rent pressures persist: Renters face rising housing costs—rent and mortgage payments grew 5.2% year‑on‑year, while utility bills rose 2.2%, both exceeding overall inflation (3.6%).

– Home ownership hopes fading: Only 12% of renters plan to buy within a year, and just 16% within five years, showing deepening pessimism in the housing market.

4. Everyday Spending & Cost of Living

– Mixed implications: Lower borrowing costs may ease discretionary spending for some, but rising food and energy prices—expected to push inflation further—continue to squeeze household budgets.

– This comes amid Britain’s ongoing cost‑of‑living crisis, with sustained pressure on essential expenditure since late 2021.

Impact on Mortgage Holders

Tracker & Variable-Rate Mortgages

Around 1.1 million UK households are on tracker or standard variable rate (SVR) mortgages. For these borrowers, the cut should mean an almost immediate reduction in monthly payments.

– Tracker mortgage: Directly linked to the base rate, so payments drop automatically.

– SVR mortgage: Lenders may choose to pass on the cut — some already have.

For example, a household with a £200,000 tracker mortgage could save around £25 a month (£300 a year) from this 0.25% cut.

Fixed-Rate Mortgages

About 85% of homeowners are on fixed-rate deals. Their payments will remain unchanged until the end of their fixed term. However, new fixed-rate deals are becoming more competitive, with some lenders offering rates below 3.8% for low-risk borrowers.

Impact on Savers

While borrowers may benefit, savers could see returns shrink.

– Easy-access savings accounts: Banks are likely to cut interest rates in the coming weeks.

– Fixed-rate bonds: Still offer higher returns, with some 1-year deals paying around 4.4%–4.5%.

– Cash ISAs: Rates may decline, so it’s wise to lock in a fixed rate now if you rely on interest income.

For savers, this is a reminder to shop around — many banks still offer better rates to new customers than to loyal ones.

Impact on Renters

Renters might hope that cheaper borrowing costs will slow rent increases. However, the effect is likely limited in the short term:

– Landlords with variable-rate mortgages may face lower costs, potentially easing pressure to raise rents.

– However, demand for rental property remains high, and supply is tight — keeping rents elevated.

According to recent data, rent and mortgage costs have risen 5.2% year-on-year, outpacing inflation.

Impact on the Cost of Living

Lower rates can boost consumer confidence, making it easier to borrow for big purchases. But the benefit might be offset by:

– Persistent high food and energy prices.

– Wage growth feeding into inflation.

– Limited savings for households already struggling with bills.

In short, this cut offers modest relief but won’t solve the UK’s cost-of-living crisis on its own.

Impact on the UK Economy

A rate cut typically:

1. Reduces borrowing costs → encourages spending and investment.

2. Weakens the pound → potentially boosts exports but can make imports more expensive.

3. Signals the central bank is concerned about growth.

The BoE is treading carefully — cutting too far could fuel inflation, but keeping rates too high risks deepening the slowdown.

What Should You Do Now?

– Mortgage holders: Check if you can remortgage to a better fixed or tracker deal.

– Savers: Consider locking in fixed-term products before rates fall further.

– Renters: Monitor market changes — rate cuts alone may not bring down rents quickly.

– Investors: Lower rates can be positive for shares, but inflation risk remains.

BoE Cuts Rates Predictions 2025

The Bank of England’s (BoE) potential interest rate cuts in 2025 are sparking plenty of debate among economists, investors, and everyday savers. With inflation cooling and growth pressures mounting, market analysts are watching closely to predict when – and by how much – the BoE might lower rates. We’ll explore expert forecasts, the factors influencing monetary policy decisions, and how possible rate cuts could impact mortgages, savings, and the wider UK economy. Whether you’re a homeowner, an investor, or simply curious about the financial outlook, our in-depth guide breaks down the latest insights into the Bank of England’s (BoE) rate-cut predictions for 2025 in clear, accessible language.

Final Thoughts

The BoE’s decision to lower the base rate to 4% will provide welcome relief to many borrowers, but less so for savers. Its overall effect on the cost of living and the wider economy will depend on whether inflation stays under control. For now, households should take proactive steps — whether remortgaging, securing savings rates, or budgeting for ongoing cost pressures.

FAQs

BoE stands for the Bank of England, the UK’s central bank. It sets the base interest rate, manages inflation, issues currency, and oversees financial stability.

The decision was announced on 7 August 2025, lowering the rate from 4.25% to 4% — the lowest since March 2023.

– Tracker mortgage: Your payments will drop almost immediately.

– SVR mortgage: Depends on whether your lender passes on the cut.

– Fixed-rate mortgage: No change until your deal ends, though new fixed deals may be cheaper.

On 7 August 2025, lowering it from 4.25%. It’s the fifth cut since August 2024, returning rates to their lowest since March 2023.

If you’re on a tracker or SVR mortgage with lenders like HSBC or Barclays, yes – rate cuts are effective from early August or September. Fixed‑rate borrowers will have to wait until their current terms end.

Savvy borrowers might remortgage to a fixed below‑5% deal (some < 3.8%) to lock in savings. Alternatively, trackers may offer short‑term relief—but come with volatility.

Likely. Easy‑access and ISA rates will fall, but longer‑term fixed bonds still offer decent yields around 4.4–4.5%.

Not yet. Inflation is above target (3.6%) and expected to surge to around 4% in September due to food, energy, and wage pressures.

Markets that expected another cut by year‑end are now scaling back expectations. The Bank signalled a more cautious path, with potential for a November cut if inflation eases.

To support a slowing economy and rising unemployment, while inflation, though above target, is forecast to stabilise.

If you’re on a tracker mortgage, yes — the change is automatic. SVR borrowers may benefit depending on lender decisions. Fixed-rate borrowers will only see changes when their deal ends.

– Review your mortgage deal for potential savings.

– Lock in higher savings rates before they fall.

– Budget for ongoing food and energy price pressures.

If your deal ends soon, compare fixed rates now — they may be more competitive after this cut.

Yes, most easy-access accounts will reduce rates, so consider fixed bonds or high-interest current accounts.

Uncertain — further cuts could come if growth weakens and inflation eases, but the BoE is cautious.